Ways in which you can give to Saint Andrew’s

- Make a pledge

Download and complete the pledge form.

Pledge form

- Electronic Giving

Login or register for online donations by credit/debit card or direct payment from your bank account. One-time and recurring donation options are available.

E-Giving

END OF YEAR GIVING

According to IRS tax rules for charitable deductions, donors must deliver checks on or by December 31 to qualify for a charitable contribution deduction for that year. Checks that are placed in the church offering during the first worship service of the year (January 1st) will not qualify for a charitable contribution deduction for the previous year, even if the check is predated to the previous year or was actually written in the previous year. However, checks that are written, mailed and postmarked within the same year will be deductible for that year even if the church does not receive it until the following year.

How can I be a good steward?

Every fall we encourage everyone to sign pledge cards to our church – believing that it is part of our personal management of the material goods God has given us. St. Andrew’s in turn is managing God’s money in the many programs of this parish.

Beyond pledging your time, talent and treasure each year, St. Andrew’s has some special areas where you can donate money when you come to specific times that you want to say “Thank You” to God or remember a loved one. Consider the following:

Friends of Music

Friends of Music

Providing added support to the operating budget for the production of special organ and choral concerts, guest musicians, choir and junior choir training and trips, and other items.

CONTACTS

Altar Flowers

Altar Flowers

Allowing you to dedicate the altar flowers for a particular Sunday in thanksgiving for, in honor of, or in memory of special people and/or events. A notation is placed in the bulletin for that Sunday with your specific dedication.

CONTACTS

Charlotte Churchill (Chair)

Youth Ministry

Youth Ministry

An active youth ministry program for grades 6-12 is available at St. Andrew’s. Activities include Sunday evening gatherings that include spiritual growth, community building, and games and food. Special trips, fund raisers and outreach projects take place throughout the year.

Stewardship

Providing scholarships to our youth who may not otherwise be able to afford to participate in special trips and events that cannot be accommodated in the youth budget. Donation may also be given to purchase specified furniture, equipment or other items for use in Youth Ministry.

CONTACTS

Outreach Committee

Outreach Committee

This committee of the Vestry seeks those with a heart of service to reach out to the community.

Funds raised for this committee help St. Andrew’s assist the community and go toward donations to such ministries as the following:

- OASIS

- Metropolitan Ministries

- Dominican Development Project

- Gabriel Tree Christmas gift program

- Local homeless shelters.

CONTACTS

St. Andrew’s Foundation

St. Andrew’s Foundation

Accepting monetary gifts for any reason, but particularly in memory of a deceased loved one, The Foundation uses the interest earned on this trust fund to help support non-operating needs of the church, such as certain repairs to the church or rectory, special youth events or trips, office equipment, children’s choir trips and camps, and other items.

More Information

CONTACTS

Project FAITH Lunch Program

Project FAITH Lunch Program

Saint Andrew’s feeds sixty bag lunches to the homeless in downtown Tampa every weekday. Gifts of food or money are appreciated to keep this program alive.

CONTACTS

Christian Education

Christian Education

This committee of the Vestry seeks to ensure that we are meeting the spiritual and religious education needs of all our members. Sunday school teachers and parents of youth and young children are welcome to offer their input on this committee.

Contact Alicia Schmid or Jim Morgan for Children CE. Contact Fr John Reese for Adult CE.

Stewardship

Providing added support to the operating budget for the purchase of Sunday School supplies, the production of special events in which our children participate, and even provides supplemental salary and/or honorariums for regular or temporary staff working with the children.

CONTACTS

St. Andrew’s Episcopal Church was established in Tampa in 1871. Its first service was held in the hospital building at Fort Brooke. A wooden church was erected in 1883 on the city block bounded by Marion, Twiggs, Morgan, and Madison.

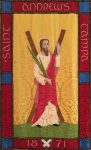

St. Andrew’s Episcopal Church was established in Tampa in 1871. Its first service was held in the hospital building at Fort Brooke. A wooden church was erected in 1883 on the city block bounded by Marion, Twiggs, Morgan, and Madison. This history of the Windows of Saint Andrew’s is based upon research by the late Laban G. Lively. Additional information has been added by Nancy Turner. It is reconstructed for presentation on the WWW by Joe Daurril. Photos taken by Chris Cobb.

This history of the Windows of Saint Andrew’s is based upon research by the late Laban G. Lively. Additional information has been added by Nancy Turner. It is reconstructed for presentation on the WWW by Joe Daurril. Photos taken by Chris Cobb. The organ at St. Andrew’s Episcopal Church, Tampa, Florida, was designed and built by C. B. Fisk, Inc., of Gloucester, Massachusetts.

The organ at St. Andrew’s Episcopal Church, Tampa, Florida, was designed and built by C. B. Fisk, Inc., of Gloucester, Massachusetts. Ministry at St. Andrew’s is an integral part of our parish life and our community.

Ministry at St. Andrew’s is an integral part of our parish life and our community. St. Andrew's seeks to ensure that we are meeting the spiritual and religious education needs of all our members.

St. Andrew's seeks to ensure that we are meeting the spiritual and religious education needs of all our members.

St. Andrew’s Episcopal Church was established in Tampa in 1871. Its first service was held in the hospital building at Fort Brooke. A wooden church was erected in 1883 on the city block bounded by Marion, Twiggs, Morgan, and Madison.

St. Andrew’s Episcopal Church was established in Tampa in 1871. Its first service was held in the hospital building at Fort Brooke. A wooden church was erected in 1883 on the city block bounded by Marion, Twiggs, Morgan, and Madison. This history of the Windows of Saint Andrew’s is based upon research by the late Laban G. Lively. Additional information has been added by Nancy Turner. It is reconstructed for presentation on the WWW by Joe Daurril. Photos taken by Chris Cobb.

This history of the Windows of Saint Andrew’s is based upon research by the late Laban G. Lively. Additional information has been added by Nancy Turner. It is reconstructed for presentation on the WWW by Joe Daurril. Photos taken by Chris Cobb.

The organ at St. Andrew’s Episcopal Church, Tampa, Florida, was designed and built by C. B. Fisk, Inc., of Gloucester, Massachusetts.

The organ at St. Andrew’s Episcopal Church, Tampa, Florida, was designed and built by C. B. Fisk, Inc., of Gloucester, Massachusetts. Ministry at St. Andrew’s is an integral part of our parish life and our community.

Ministry at St. Andrew’s is an integral part of our parish life and our community. St. Andrew's seeks to ensure that we are meeting the spiritual and religious education needs of all our members.

St. Andrew's seeks to ensure that we are meeting the spiritual and religious education needs of all our members.